In summary

In 2025, commercial & industrial (C&I) solar in Europe is entering a phase of steady yet structuring growth: companies are betting on self-consumption to reduce energy costs, battery storage is becoming essential to optimize and secure production, and new financing models (PPAs, leasing, solar-as-a-service) are democratizing access without upfront investment. Artificial intelligence and smart monitoring are transforming real-time energy management, while an increasingly supportive regulatory framework (mandatory solar on buildings and parking lots, tax incentives) accelerates the transition.

The result: in 2025, C&I solar is no longer just an option, but a strategic lever for competitiveness and resilience for European businesses.

Introduction

This article is the second part of our series on C&I photovoltaics. In the first article, we defined what the C&I segment is and which stakeholders are directly involved. We now take a closer look at the major trends and market outlook in Europe for 2025 and beyond.

The European C&I solar market remains well oriented but is entering a normalization phase after two exceptional years. In 2024, the EU added 65.5 GW of solar (a new record, but only +4% vs. 2023). For 2025–2028, SolarPower Europe now anticipates moderate growth of around 3–7% per year, driven more by large ground-mounted plants while the residential and part of the C&I segments slow down. These projections contrast with older forecasts (2022) that had predicted double-digit growth. In 2025, SPE even foresees a slight contraction in additions compared to 2024 before a gradual rebound: a sign of relative slowdown, not a trend reversal.

1. Steady growth and massive investments

Solar is now a pillar of the European energy mix: in 2024, it hit a new record for installations in the EU and continues to gain market share in electricity generation. Germany surpassed 100 GW of cumulative PV capacity, driven by strong rooftop and ground-mounted additions. Industrial appetite is also reflected in the rise of corporate PPAs in Europe, which structure part of the C&I demand.

To analyze trends with a business perspective, it is better to think in terms of 2025–2028 (or even 2030) rather than “2025 only,” because C&I dynamics depend as much on wholesale prices, PPAs, storage, and injection rules as on the year in isolation.

Growth is explained by the maturity and record competitiveness of the technology. Since 2022, PV module costs have dropped significantly thanks to global overcapacity, reaching in 2024 their lowest point in a decade. As a result, for professional consumers, the levelized cost of solar electricity (LCOE) is now below grid power prices in most European countries. At the same time, accumulated installer experience enables faster delivery and higher reliability. Investing in solar has never been more accessible and profitable for businesses.

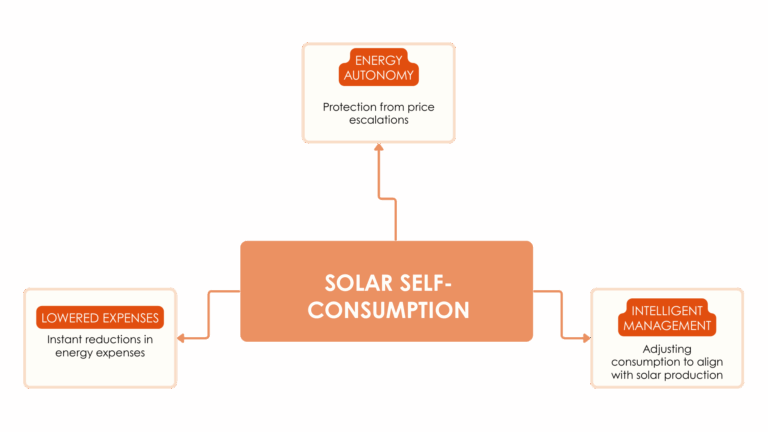

2. Self-Consumption: a strategic priority amid rising energy prices

The surge in electricity prices since the 2022 energy crisis left a lasting mark. For companies, every kilowatt-hour saved or produced in-house is a breath of fresh air. Solar self-consumption has thus become a strategic necessity. Producing and consuming one’s own power immediately cuts bills while shielding against future price hikes. In an uncertain supply and volatile market environment, this control is invaluable.

Concretely, more and more companies are seeking to maximize on-site solar consumption. Smart energy management solutions help match consumption with solar production (e.g., running machines in the afternoon when the sun is at its peak). This trend is supported by technological advances (see later) and experience: today, systems are sized much more closely to actual needs.

In self-consumption, a company replaces part of its grid purchases with local production: every on-site kWh avoids paying the retail tariff (energy + transmission + taxes), while surplus injected into the grid is usually paid at a lower export price. This “retail – export” gap underpins the profitability of C&I self-consumption in Europe. In markets with high retail tariffs, the model is particularly attractive: hence the rise of PV + storage coupling to maximize on-site use.

3. Energy Storage: the ally of resilience and optimization

Pairing solar panels with batteries is booming in the C&I sector. Why? Because storage meets two major needs: it increases the self-consumption rate (storing the midday surplus for evening use, for example), and it boosts resilience against grid instability.

In Europe, the solar boom is beginning to strain grid infrastructure at times (midday production peaks sometimes exceed demand, even causing negative market prices). Batteries help avoid grid overload by keeping electricity on-site for later use, optimizing both economic and ecological benefits. For companies, storage also means securing supply: in case of outages or peak demand, batteries can back up critical uses. This is fueling interest in micro-grids or semi-autonomous sites, where a solar + storage plant can keep a factory running in temporary isolation if needed.

Technologically, lithium-ion battery costs have fallen while reliability has improved, making them suitable for commercial and industrial uses. Suppliers now offer integrated PV + storage + smart management systems for the C&I market. Energy-intensive industries and data centers are leading the way: in 2024, they invested in solar + storage plants aiming for 24/7 renewable supply. This trend will grow in 2025. In short, storage is becoming inseparable from C&I solar for any company wishing to maximize its installation and shield against risks.

4. New Financing Solutions: the boom of PPAs and “Solar-as-a-Service”

Historically, the upfront investment was a barrier to business adoption of solar. But the good news: it is increasingly unnecessary to pay for a solar plant yourself. New financial models are democratizing access to C&I solar, especially long-term Power Purchase Agreements (PPAs), leasing, and third-party investment.

The principle of a PPA is simple: a third party (energy producer, investment fund) finances and installs the solar system on your site, and you commit to buying the electricity produced for X years at a fixed rate. No capital expenditure is needed, and you get a stable, lower price than the grid. This model is booming in Europe: nearly 19 GW of renewable projects were contracted via PPAs in 2024, mainly solar and wind. Over 70% of these contracts are corporate PPAs, signed directly by businesses securing long-term green supply.

Other options are also rising: solar leasing allows companies to pay a monthly fee instead of upfront investment. Energy service providers offer turnkey solutions without CAPEX (e.g., the Idex model, where the operator finances the project and the company only pays for the produced energy). Crowdfunding or third-party financing (energy communities, regional funds) is also encouraged in some countries.

These innovations change the game: today, companies can switch to solar without upfront CAPEX, removing a major hurdle. Immediately, they cut costs by buying cheaper solar energy, from year one. In France, for instance, more and more C&I projects are built with third-party financing or private PPAs, accelerating deployment. Solar is thus becoming democratized, even for businesses with limited investment capacity, thanks to win–win models.

5. Technological Innovation: AI and smart monitoring serving solar

The digital revolution hasn’t left photovoltaics untouched. Artificial intelligence (AI) and smart management systems are entering C&I installations to optimize performance.

AI-driven software can analyze solar production, site consumption, and electricity market prices in real time to optimize energy use. They can decide when to charge or discharge batteries, or modulate certain equipment (HVAC, EV chargers), maximizing self-consumption and minimizing costs.

This fine, automated management delivers several benefits: avoiding grid purchases at expensive peak hours, avoiding unprofitable reinjection when the grid is saturated, and overall channeling each kWh to the best use. For example, as early as 2020, Enerdeal’s headquarters in Belgium combined solar panels, storage batteries, and EV chargers, all managed by AI.

Result: maximized self-consumption and avoided grid upgrade costs. Today, more providers offer online monitoring platforms to track production, detect failures, and recommend actions (panel cleaning, angle adjustments, etc.). AI can even forecast solar production (via weather) and anticipate consumption, enabling predictive energy management.

In short, digitalization of C&I solar is underway: IoT sensors, big data, and smart algorithms are making systems more efficient, easier to maintain, and better integrated into building energy systems. This trend will intensify in 2025, as squeezing every bit of energy savings becomes crucial. Tomorrow’s solar will be high-tech:a great advantage for businesses seeking maximum value.

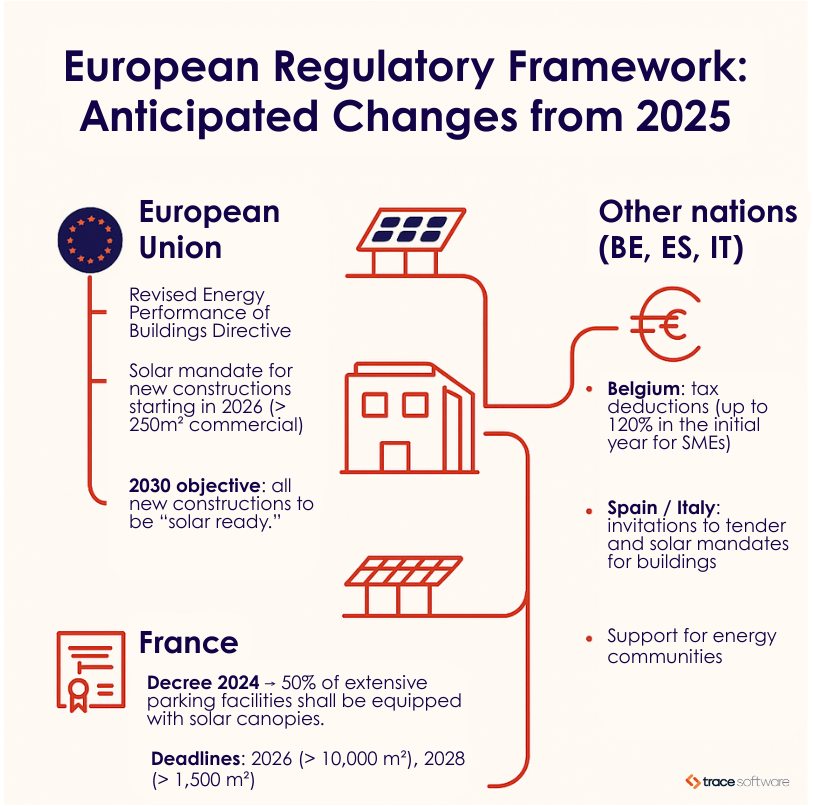

6. A more supportive regulatory framework

European policymakers have understood the importance of involving businesses in the solar rollout. 2025 marks the entry into force of new regulations favoring solar on buildings. The EU notably adopted the revised Energy Performance of Buildings Directive (EPBD), which includes the “EU Solar Rooftop” initiative. From 2026, all new commercial and public buildings over 250 m² will need rooftop solar when built. By 2030, the aim is for all new buildings (including residential) to be “solar-ready” or equipped, and even large existing non-residential buildings must integrate solar during major renovations. This trend points toward a legal obligation making PV a standard building component, like insulation or heating.

At the national level, regulations are also evolving. In France, a November 2024 decree requires 50% of large parking lot surfaces to be covered by solar canopies (or vegetation). Deadlines: July 2026 for lots over 10,000 m², July 2028 for those 1,500-10,000 m². Companies with large parking areas (shopping malls, airports, exhibition centers) are directly concerned and have already launched solarization projects. Other measures ease deployment: in France, since late 2024, canopies and ground-mounted systems under 3 kWp no longer need a building permit, only a simple declaration: a small but symbolic step.

In Belgium, Spain, Italy, and elsewhere, incentives include tax deductions (e.g., accelerated depreciation of solar investments up to 120% in Belgium for some SMEs), tenders dedicated to rooftop PV, or mandatory renewable percentages in new builds. Overall, the regulatory environment is very favorable: companies benefit from equipping now to leverage subsidies, comply with upcoming standards, and save money.

Conclusion

In short, C&I solar trends in Europe in 2025 can be summed up as a broad acceleration. More projects, new financing tools, smarter technologies, and supportive regulation- all signals point to solar becoming a central element of corporate energy strategy.

To turn these opportunities into concrete results, careful project design and sizing are essential. Professional solutions such as archelios PRO enable simulation, analysis, and profitability optimization of PV installations from the design stage. A decisive asset to secure investments and maximize project value.

This article was written by:

Carl WARD

Photovoltaic Product Manager - Trace Software

Carl WARD plays a key role in the development of our archelios range, dedicated to the design and optimisation of photovoltaic projects. "We are passionate about managing these solutions, and thanks to our expertise, we can help professionals to make solar energy more efficient, accessible and sustainable."